It is remarkable how far apart the discussion on reducing emissions is nowadays in the Netherlands and Germany, argues SWZ|Maritime’s editor-in-chief Antoon Oosting in his latest opinion piece. Whereas the Dutch seem to be looking at all new types of fuels and propulsion, the Germans still see LNG as a reliable solution to get to zero emissions.

In every issue of SWZ|Maritime, Oosting writes an opinion piece under the heading “Markets” about the maritime industry or a particular sector within it. In the April 2021 issue, he discusses the difference in focus between the Netherlands and Germany when it comes to reducing shipping’s emissions.

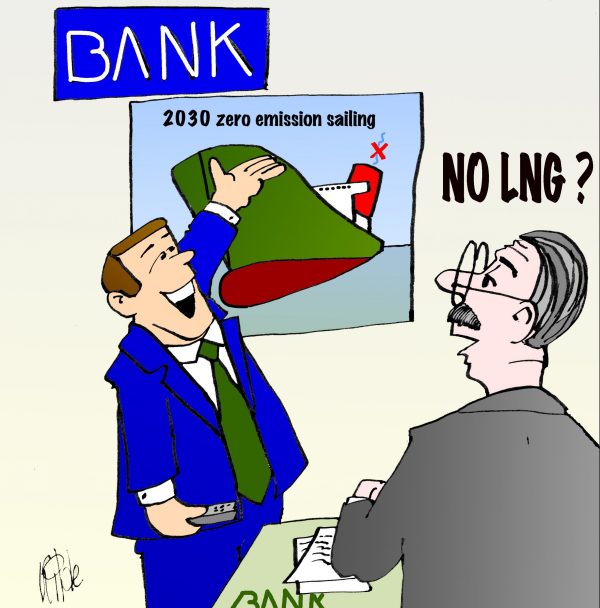

The latest edition of the Dutch Clean Shipping Platform (Platform voor Schone Scheepvaart) webinar on the 10th of February focused on the development of alternative fuels and propulsion to get to zero-emission shipping with the conclusion that there is no future for fossil fuels like LNG. The theme of the last online conference of MARIKO GmbH in Leer, Germany, however, was “LNG as fuel: Status update – Current experiences & perspectives for the application of LNG as fuel in shipping”.

The difference between the two is that the Dutch Platform is a broad network of the organisations of the Dutch shipowners, the Dutch maritime industry, Dutch maritime research institutes MARIN and TNO and the NGO Stichting De Noordzee. MARIKO is a private enterprise company with an interface function in the maritime economy. MARIKO supports networking activities and initiates research and cooperation projects, especially in the Ems-Achse region. The LNG Agentur Niedersachsen, the German Shipowners’ Association, Bureau Veritas and again the Dutch shipowners’ organisation KVNR participated in the MARIKO webinar referred to.

Tremendous differences

Of course, you cannot compare the webinars as they have a totally different focus, yet they might say something about the differences between the Dutch and German maritime industries. They are so close to each other, but there are tremendous differences.

The R&D of the Dutch maritime industry very much focuses on developing solutions for the future. And as such, it is close to the political priorities set by the European Commission’s Green Deal policy and the Dutch Green Deal on Maritime and Inland shipping and Ports launched in June 2019. This is a fairly ambitious programme that aims for a seventy per cent reduction of CO2 from shipping by 2050 and a twenty per cent reduction as early as 2024.

Strengthening maritime industry’s future position

To achieve this, the Dutch maritime industry has developed a very ambitious Maritime Master Plan that has to result in thirty zero-emission ships as early as 2030. The Dutch maritime industry is asking for 250 million euros of support from the National Growth Fund of the European Recovery & Resilience Fund (RRF).

According to the maritime industry, the recovery after the Covid-19 pandemic offers an opportunity to accelerate the maritime energy transition. ‘The Netherlands must become the world leader in sustainable shipbuilding and shipping,’ said Rob Verkerk, president of Maritime by Holland (Nederland Maritiem Land). ‘With this initiative, the Dutch Government will be the first to sail emission-free ships and we will strengthen our international competitive position.’

The recovery after the Covid-19 pandemic offers an opportunity to accelerate the maritime energy transition.

The maritime industry knows from experience that it can’t rest assured of political support for maintaining a viable sector. Forced by fierce Asian competition, the Dutch shipbuilders had to restrict their focus on niche markets such as the dredging, naval and superyacht industry. All of it in itself important, but in numbers of jobs for Dutch personnel, it can’t compete with other, bigger industries.

A lot of ship types can’t be built in the Netherlands anymore. The super- and mega yachts built on Dutch yards are the pinnacle of design, but don’t expect cheers from the public when they end up in the hands of Russian oligarchs or other controversial personalities. Not to mention the troubles when Dutch warships are sold to less democratic, more corrupt regimes. The Dutch maritime industry is therefore always lagging behind competitors in countries like Italy, Spain, and France that seem to have fewer reservations about this.

Investment in the future

R&D is in fact an investment in knowledge that you want to use in the near or later future. But to have the best return on an investment in knowledge, it is most profitable when you can use it in your own productions. So, use Dutch R&D in Dutch production, which in the case of the Maritime Master Plan means to use this R&D for building ships at Dutch yards. The knowledge developed within the Master Plan could for example be of use to the badly needed renewal of the Dutch short sea fleet.

And those ships can still be built at the highly efficient shipyards in especially the north of the Netherlands. Yards that are also able to build a lot of other, smaller specialised vessels like dredgers, fishing vessels, all kinds of smaller workboats and navy vessels. Royal IHC on the other hand, can also still build the bigger dredgers, besides the standardised smaller cutter and hopper dredgers.

To be able to profit from the knowledge being developed within the framework of the Maritime Master Plan, the shipyards in the Netherlands need to get access to reliable knowledge as soon as possible

The big bulkers, tankers, container ships and bigger cruise vessels, however, will never be built in the Netherlands anymore. To be able to profit from the knowledge being developed within the framework of the Maritime Master Plan, the shipyards in the Netherlands need to get access to reliable knowledge as soon as possible.

When the R&D process and the knowledge being developed within the Plan take too much time to become available and commercially interesting for the shipyards and the investors in shipping, it might be too late for Dutch shipbuilding to survive. The competition not only in Asia, but also in Europe itself is not leaning back. Shipyard De Hoop and also Damen have already experienced how strong this competition is.

Also read: ‘New, greener types of ships need a lot more R&D’

Fierce competition

After having built two fine expedition cruise ships for Celebrity Cruises last year, De Hoop still hasn’t booked any follow-up orders. And Damen also didn’t succeed in getting orders for building cruise ships at the recently obtained Mangalia shipyard in Romania. Ships that do get built by Vard in Romania and the Brodosplit shipyard in Split in Croatia for example.

If Dutch shipbuilders have any competitive edge towards their competitors, it is very fragile. They are still missing out on very interesting orders for being too expensive. So, if Dutch shipbuilders want to survive, they need some advanced knowledge as soon as possible, preferably now and not in ten years’ time.

The knowledge the shipyards need to have access to, not only needs to be advanced, but also needs to be proven technology

In fact, the knowledge the shipyards need to have access to, not only needs to be advanced, but also needs to be proven technology. A shipowner needs a reliable business plan based on reliable technology that works with fuels that can be obtained against commercially competitive costs.

Alternative fuels that still cost several times as much as the heavy fuel oil (HFO) and marine gas oil (MGO) fuels that are in use today, are of no use to shipowners that have to prove to their bankers or other investors how they will be guaranteed that theirs loans or investments will be paid back.

Tackling methane slip

A fuel technology that is much cleaner, emits practically no particles as there is no SOX, up to 95 per cent less nitrogen oxides and until today twenty to up to 25 per cent less carbon dioxide (CO2) emissions is the use of LNG. That the reduction in CO2 emissions remains limited to a maximum of 25 per cent is due to the problem of methane slip; unburned methane that slips out of the engine during the combustion process.

As can be read in our March 2021 issue in the article of Kees Kuiken and Willem de Jong, engine manufacturers like Wärtsilä, MAN Energy Systems and WinGD put a lot of effort in reducing methane slip, hopefully resulting in a greater acceptance of LNG as a reliable fuel for shipping.

Good experiences with LNG

Because reliable it is, as three shipowners told during the webinar of MARIKO: German shipowner Wessels Marine that had the WES Amelie retrofitted to LNG, Swedish product tanker company Terntank and our own Dutch gas tanker specialist Anthony Veder.

Terntank, which has four vessels sailing on LNG, claims to have reduced its CO2 emissions by no less than forty per cent, SOX by 99 per cent, NOX by 97 per cent, and particles by 99 per cent and, important for the crew and inhabitants that live close to ports where ships pass by, the ships also emit forty per cent less noise. Terntank has been able to reduce its operating expenses (OPEX) considerably and has ordered another two vessels that will operate on LNG.

These positive conclusions about the use of LNG in shipping are also endorsed by Rotterdam-based shipowner Anthony Veder, which manages a fleet of 31 tankers of which ten sail on LNG. Anthony Veder is active in the transport, distribution and bunkering of LNG in all of western Europe.

According to Björn van de Weerdhof, manager business and fleet development, LNG is available, scalable, affordable, safe, technologically mature, compatible with future zero-emission fuels such as bio-LNG and e-LNG, bankable as approved by the Poseidon Principles and leads to lower total costs of ownership. This is just the kind of language fellow shipowners and their investors and bankers like to hear.

LNG is available, scalable, affordable, safe, technologically mature, and compatible with future zero-emission fuels such as bio-LNG and e-LNG

So, don’t write the use of LNG for shipping off yet. Moreover, Dutch maritime service suppliers can still play an important role in helping Dutch shipowners with retrofitting or engineering new ships sailing on LNG. Like Cryonorm already helped several shipowners at home and abroad (Spain and France) with installing an LNG fuel system, this could still be a reliable solution for other Dutch shipowners as well.

Also read: ‘The research is there, but who will invest in zero-emissions ships?’

Picture by CarletonLiisa/Wikimedia.