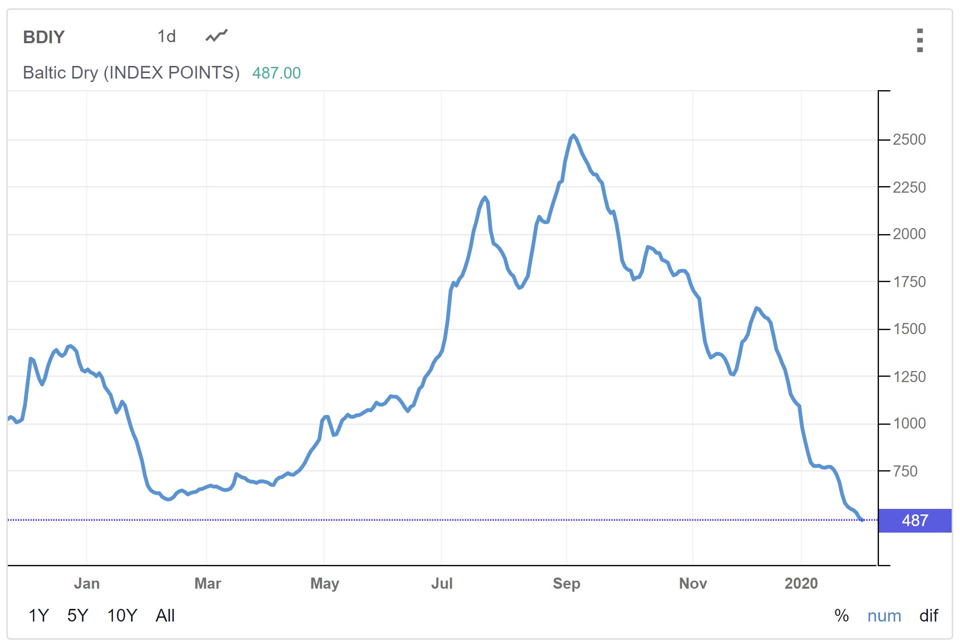

The Baltic Dry Index has dropped to its lowest point in four years time as a result of the coronavirus, IMO 2020 and seasonality. The index currently stands at 487 points, down more than 1100 points in comparison with the beginning of December last year.

The last time the Baltic Dry Index dove below 500 points was in February 2016, arguably the toughest year for shipping since the start of the millennium. The Baltic Cape Index for Capesize dry bulk vessels was down to just one index point on January 30th.

‘IMO 2020 takes it toll, alongside the coronavirus and seasonality,’ comments BIMCO’s chief shipping analyst Peter Sand on Twitter. ‘Ships with scrubbers are capable of running an almost profitable freight rate, but since the Baltic Dry index considers only ships without a scrubber, high fuel costs are really bringing down index readings and Time Charter Equivalents,’ he adds.

Baltic Cape Down to ONE index point for a non-scrubber fitted ship. #IMO2020 takes it toll alongside seasonality and coronavirus. #drybulk @Splash_247 pic.twitter.com/6iA3A9xbpc

— Peter Sand (@BIMCO_PS) January 30, 2020

Capesize slumps to record low as IMO oil rules | “Ships with a scrubber are capable of running an almost profitable freight rate, but since the Baltic considers only ships without a scrubber, high fuel costs are really bringing down index readings and TCE” https://t.co/dteGihCnZ8

— Peter Sand (@BIMCO_PS) January 31, 2020

Steel and metals

The multipurpose shipping industry will also be impacted as steel volumes, an important base cargo for project carriers, will likely be affected too. On one hand, steel production will suffer from the extended Lunar New Year break in China, while on the other hand, the iron ore supply to the mills could be disrupted by slower port operations. According to S&P Platts, mills relying on trucks for their supplies have already said they may face raw materials shortages by the second half of February.

The emergence of the virus during the Chinese holidays could prove to be a silver lining ‘as seasonally slow demand in China may absorb much of its downside impact on the metals markets,’ states S&P Platts. Nonetheless, the analyst firm says ‘it is already certain to result in a weaker-than-usual first quarter.’

This article first appeared on Project Cargo Journal, a sister publication of SWZ|Maritime.