‘Why build port infrastructure to accommodate 20,000 TEU vessels when supporting systems can only handle 6000 TEU a day?’ says Belt and Road Initiative (BRI) specialist Andre Wheeler. Indeed, an 18,000 TEU container ship means 9000 containers and about 100 train loads. The larger the vessel, the more complex is the transshipment for hinterland transportation.

The Belt and Road initiative (BRI) is not only the growing network of rail freight connections between Europe and China. It is the integration of maritime and land-based transportation and logistics routes between these continents. A seamless connection between ports and hinterland networks is the ultimate goal. While the connections between the dots are drawn, the pairing of ports and land routes is everything but moving forward, thinks Wheeler.

The Australian-based academic is currently working towards his doctorate on the impact of the Chinese BRI on infrastructure and logistics. In his writings, he expresses his concern over the tendency of ports to get bigger and smarter, while the gap with land-based transport gets larger and larger.

Mega Ships

A first indication of this trend is the size of vessels nowadays. Take the Mette Maersk, which left China last week bound for the UK. Packed with Christmas goods and promoted with much fanfare, this vessel has a container capacity of 18,000 TEU. The receiving port of Felixstowe stands proud to be able to receive such volumes. However, the supply chain often does not end at the harbour any more, says Wheeler.

With the BRI project, the focus is much more on hinterland transport than before, and therefore a mind shift is required, Wheeler argues. ‘By pairing ports with rail networks, a new logistics hub and spoke framework is developed, focussing on end-to-end delivery rather than on the current port-to-port model,’ he explains. ‘With quicker delivery times afforded by tighter rail-shipping pairing, there would be less need to ship large quantities in one go. I would argue that the optimal vessel size is rather in the 10,000 to 14,000 TEU range.’

The supply chain often does not end at the harbour any more

IT Platforms

This “tight pairing” does not only rely on size, he continues. ‘Logistics providers, using integrated IT platforms, can now offer a more comprehensive service by organising all activities in the logistics chain, from customs clearing, to transport to the factory – allowing for manufacturers to deal with one logistics provider rather than a plethora of shipping agents and port authorities.’

Yet, the IT platforms needed to organise such complex solutions have yet to be harmonised if they are really to support trade in a global sense. This is another element in the chain that deserves attention, Wheeler says. ‘While ports claim to be smart, they are not actually communicating with each other. There are different systems into place, moving away rather than to a standardised digital network.’

While ports claim to be smart, they are not actually communicating with each other

Incompatible Data

‘At a macro level, we have two broad-based data platforms emerging. On the one hand, you have the US’s GPS data tracking system and on the other there is the Chinese BeiDou Navigation tracking system. As these do not communicate, it is becoming increasingly apparent that global shippers and freight forwarders will have to use two incompatible data sets if they are to trade across the West/East divide,’ says Wheeler.

‘Furthermore, at a micro level, recent digital developments are creating independent business silos that hinder data transfer across and within industry,’ he notes. With this last remark, he means the multiple digital solutions that evolve across the entire chain, promising to integrate all stakeholders. However, these ports are not that smart in digitally communicating with other ports or land-based transport operators, the academic notes. ‘It is at this digital interface that things fall and it suggests there is still a way to go before we will get to an understanding of what a real smart port will be.’

Recent digital developments are creating independent business silos that hinder data transfer across and within industry

Challenge

Systems such as an Application Programming Interface (API) and Electronic Data Interchange (EDI) standards would allow differing operating data systems to communicate with each other, Wheeler explains. However, this is easier said than done. ‘Again, it is about which system you choose. API is more accessible and much faster, while EDI is more secure. Ideally, API suits the need of the e-commerce industry, but not everybody is willing to give in on data security, so again there is a lack of harmonisation.’

He concludes: ‘Until various countries and actors reach consensus over such matters as to which system to use, there is little parity among ports and other logistics platforms, and a smart port and supply chain will forever be a utopian vision.’

European Silk Road Summit

Do you want to know more about the New Silk Road and its latest developments? On 26 and 27 November the European Silk Road Summit takes place in Venlo, the Netherlands. At this two-day international event more than 35 speakers and around 250 delegates will share their experiences, expertise and latest news. Registration for the event is still open. The programme and speakers can be found on the website.

This article was first published on Railfreight.com, a sister publication of SWZ|Maritime.

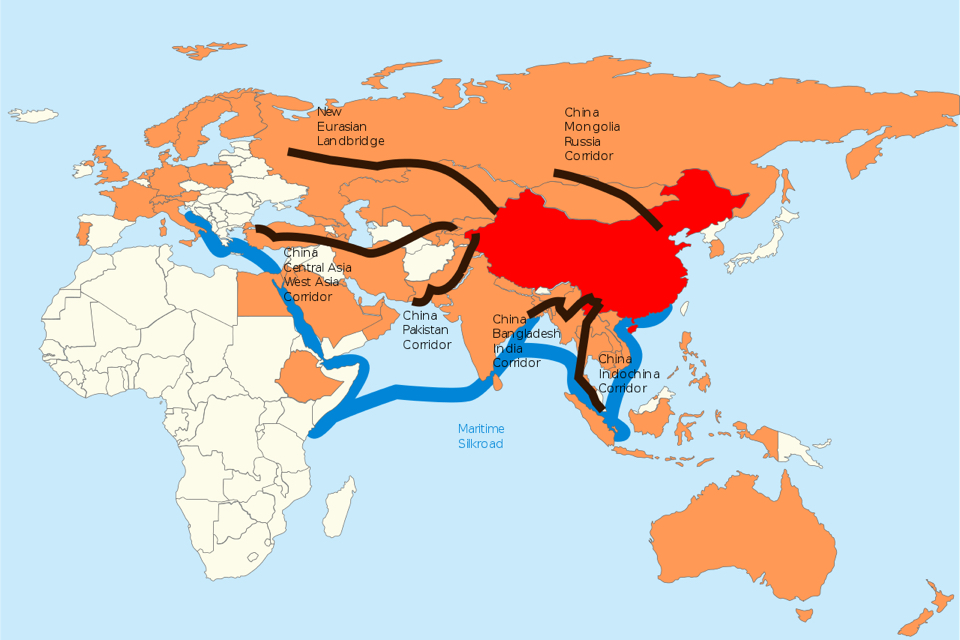

Picture: BRI: China in red, Asian Infrastructure Investment Bank (this multilateral development bank aims to support the building of infrastructure in the Asia-Pacific region) member countries in orange, the six

country corridors in black, the shipping route in blue (image: Lommes).