From the magazine – The Drechtsteden region houses the most important cluster of the Dutch maritime manufacturing industry. The seven municipalities in the region, as “Smart Delta Drechtsteden”, support the regional shipbuilding cluster that has grown around the intersection of three important waterways (Beneden Merwede, Noord and Oude Maas).

This article appeared (in Dutch) in SWZ|Maritime’s October 2023 issue and was written by Hans Heyen, maritime journalist, hans.heynen@casema.nl.

The cluster in the Drechtsteden includes internationally renowned shipbuilding, supply, dredging and inland shipping companies. The seven municipalities involved are Alblasserdam, Dordrecht, Hardinxveld-Giessendam, Hendrik-Ido-Ambacht, Papendrecht, Sliedrecht and Zwijndrecht.

The executive organisation “Deal Drechtsteden” is responsible for the promotion, acquisition and improvement of the business climate for the maritime companies in this region. ‘We help companies find an ideal location, stimulate innovation and establish connections between maritime companies,’ says director and maritime specialist Martin Bloem of Deal Drechtsteden. ‘We are also the secretariat of the Economic Development Board Drechtsteden.’

Recently, Deal Drechtsteden completed a study, conducted with branch organisation Netherlands Maritime Technology (NMT), that shows how the maritime manufacturing industry in the Drechtsteden functions, which players and sub-clusters are active in it and what the relationship is between the various maritime companies. The study formed the input for a Sector Agenda for Marja van Bijsterveldt, the maritime manufacturing industry envoy (and mayor of Delft). The Sector Agenda must provide broadly supported working solutions for an industrial policy that can keep the maritime manufacturing industry healthy. Measures to strengthen and protect regional shipping clusters are part of this. ‘In the study, we clearly highlight the great strategic importance of this regional cluster for the Dutch and European maritime manufacturing industry,’ says Bloem.

Also read: Financing of incremental greening of maritime sector essential

Four value chains

The study distinguishes four value chains: hydraulic engineering, luxury yacht building, inland shipping and the construction of work vessels.

‘At the top of the four value chains, orders are received separately,’ says Bloem. ‘However, the deeper you go into the value chains, the more they appear to be interconnected. At the bottom of the chain, it is almost impossible that a company works for only one of the four chains. Steel builders, engine installers and electronics suppliers supply to all the chains. The companies at the bottom of the chains contain a lot of valuable knowledge. After-sales and refits also play an important role in these chains.’

He adds: ‘A certain volume is very important to maintain a complete and strong cluster. For companies at the bottom of the chain, this volume is the sum of the four value chains. When one value chain loses crucial components, a problem arises that affects not only the value chain in question, but also the three others.’

Four clusters

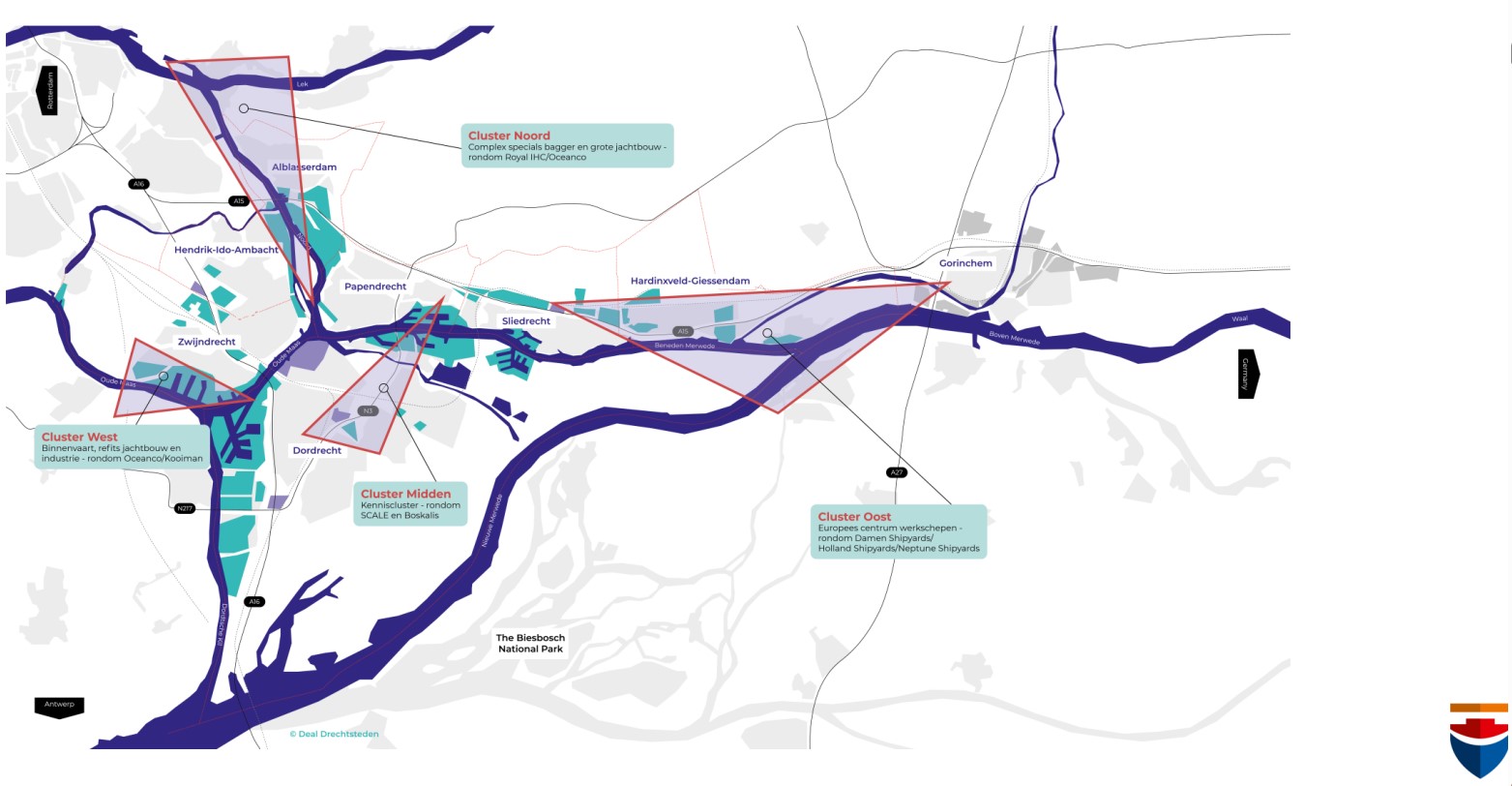

The maritime manufacturing industry in the Smart Delta Drechtsteden is geographically concentrated around four central clusters, which are interconnected, but also have their own specialisation and dynamics (also see the picture below). The “Agenda 2030 Maritime Manufacturing Industry Drechtsteden”, commissioned by Smart Delta Drechtsteden, is divided as follows.

The metal cluster has traditionally been located in the North Cluster, in and around the Alblasserwaard (Alblasserdam, Kinderdijk, Nieuw-Lekkerland and Hendrik Ido-Ambacht). Large steel and aluminium constructions are manufactured here and complex hull and ship construction takes place for dredging, offshore and superyacht construction.

In the East Cluster, around Hardinxveld-Giessendam, Gorinchem and Werkendam, special ships are built for inland and coastal shipping as well as workboats. The shipyards and suppliers located here supply their products internationally.

The West Cluster is taking shape in Zwijndrecht, with refit and maintenance for inland shipping and large yacht construction, including the associated trade and knowledge.

The Cluster Midden in Papendrecht and Dordrecht houses a high-tech cluster with an associated knowledge offering.

The four related clusters are in turn strongly interwoven with the activities in the Rotterdam region, including Delft, Schiedam and Krimpen aan den IJssel. On an even larger scale, it is one of the leading maritime technology clusters in Europe, together with partner regions such as Hamburg-Bremen, and the Oslo-Copenhagen-Helsinki triangle.

Strategic issue

From this perspective, the situation at Royal IHC seems to be a point of concern. The shipbuilder, which specialises in the construction of advanced dredgers, cable layers, pipe layers and other work vessels, is high up in the chain. In addition, IHC is also an important supplier of components.

‘IHC, like other shipyards, has its own responsibility to survive,’ says Bloem. ‘If that no longer works, it will quickly end. At the same time, this is a strategically important company for the Netherlands and even Europe. Do we want one or more winners in the Netherlands with whom we can compete internationally in shipbuilding? That makes this a national issue.’

Perhaps a Centraal Staal-like company is part of the solution, a company in which various shipyards take a share. ‘We see a huge demand for steel from the yacht building industry in this region, with orders for yachts up to 140 metres,’ says Bloem. ‘It is the fastest growing sector here and the hulls are largely built locally (such as by Slob and Zwijnenburg). New locations are required for hulls of 130 to 140 meters. This could be done in the IHC area, but then companies would have to cooperate and combine activities. Every company can do the finishing independently. You have to carefully calculate how much steel capacity everyone needs and see how production can be made more efficient in such a collaboration.’

‘Obtaining orders for the construction of naval vessels and ships for the Government Shipping Company will then become a more realistic option,’ Bloem continues. ‘If there is a good and competitive offer, government tenders can be linked even more to Dutch shipyards.’

In this context, Bloem points out that shipbuilding in the Netherlands and Europe is at a tipping point. ‘Of the global order intake, only two per cent goes to Europe. China and South Korea are the big players, with China receiving fifty per cent of the orders this year. We must look carefully at our strategic interests in Europe and the Netherlands. Whether we will still be able to build naval ships and other ships ourselves in the future. I notice that politicians currently recognise this and are willing to think along. The maritime lobby is paying off in that respect. There is broad support in the House of Representatives with a Maritime Master Plan and a Sector Agenda to make the maritime manufacturing industry future-proof.’

Also read: Another net loss for Royal IHC, but upturn seems to be afoot

Bundling suppliers

Specialised supply companies are indispensable for a competitive and innovative Dutch shipbuilding industry in the Drechtsteden. Bundling such companies in places where their activities are well aligned strengthens the competitive position.

‘This is possible in the second and third Merwedehaven in Dordrecht and at Pier 14 in Zwijndrecht,’ says Bloem. An example of a company that has more space at a new location, so that it can work more efficiently, is engine supplier and finisher Dolderman. ‘They were completely stuck in the city centre of Dordrecht, between the Binnen- and Buiten Kalkhaven,’ explains Bloem. ‘The move to the second Merwedehaven has been years in the making. But this way you can see how you can optimise things for every water-related company. The problem is that there is actually no new land bordering the river available for release. It is mainly redevelopment and combining companies in a smart way to make optimal use of the space.’

Also read: Ship repair sector grows and thrives in Rotterdam’s Waalhaven

Putting the maritime industry first

In urban areas, regulations on the spread of particulate matter and noise (particularly peak noise) pose challenges.

‘There are still plenty of opportunities in the Dordrecht seaport for the establishment of maritime companies, but when you start outfitting ships there, it will cause some noise pollution. Local residents often feel connected to the industry and do not have much trouble with those peak noises. The municipality is also willing to cooperate. It is mainly the regulations themselves that make it difficult,’ states Bloem.

‘If some protected bats or nitrogen emissions are added, it will not become easier for a company to establish itself there. This is a busy area with many rules and many players. That does not make it easy to realise all maritime ambitions. It takes political courage to occasionally put the great maritime importance of the region first. The councilors in charge of this in the Drechtsteden are all passionate about the industry, but they too sometimes get stuck. We therefore advocate a number of zones around companies with less strict rules.’

Picture (top): Oceanco also builds yachts in Zwijndrecht these days, such as this one that will soon be 109 metres long (photo Oceanco photo for Deal Drechtsteden).