Electric motors are increasingly conquering European waters. Initially eyed critically, the quiet and climate-friendly electric boats are beginning to gain acceptance and popularity. The latest market research [1] forecasts average annual growth of 12.7 per cent for electric boats until 2028 (CAGR).

The analysts expect the strongest growth in Europe ahead of North America and the Asia-Pacific region [1].

What is behind the hype and how is the market for electric boats developing in the individual European countries? The new “Electric Boat Market Study 2023” by boats.com gets to the bottom of this question. It analysed which European countries are ahead in electric boats and in which price segments electric boats are predominantly available. For the study, boats.com analysed the data of eleven leading European online sales platforms for boats that have joined forces under the umbrella of Boats Group, the leading platform for the boat trade.

In total, the analysis includes the search behaviour of 46 million active potential buyers particularly across the six main European marketplaces in UK, France, Italy, Spain, Netherlands and Germany of Boats Group. The data on which the study is based covers the period of the past four years (2019-2023). Additionally, the boat sales on the platforms by over 4000 brokers, dealers and original equipment manufacturers were analysed. Here are the key findings of the study:

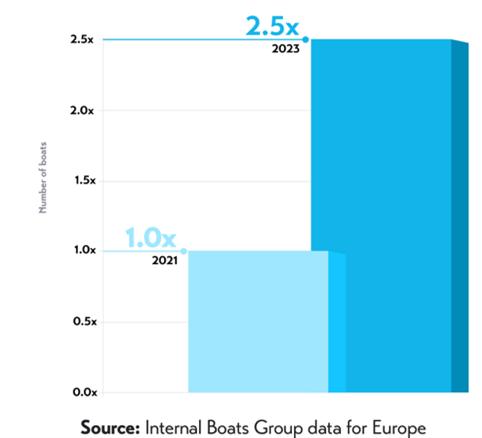

Supply increased by 2.5 times in the last two years

Since 2021, the range of electrically powered boats on the online sales exchanges has increased 2.5 times. Compared to 2019, the online exchanges recorded that the total electric boat listings on the platforms increased by sixty per cent in 2021, 160 per cent in 2022, and 190 per cent in 2023.

Dutch and French particularly interested

The Google Trend Analysis reveals that interest in electric boats is not equally strong in all countries across Europe. For example, the search engine recorded a particularly high number of searches for electric boats in the Netherlands, Norway and France.

In Belgium, Sweden, the UK and Ireland, there are also comparatively many searches for electric boats.

Interest seems to be less pronounced among Spaniards and Germans at the moment. These countries are the worst performers in the search rating.

UK, Netherlands and Germany provide largest supply

Most of the electric boats listed for sale on the online marketplaces have their moorings in the UK (1st place), the Netherlands (2nd place) and Germany (3rd place).

While interest is also high in the UK and the Netherlands according to Google Trend Analysis (above), a different picture emerges in Germany. There, the industry seems to be further along than the buyers: Although the country is one of the top 3 suppliers of electric boats, Germany records lower search queries for electric boats than other countries.

The southern European boating industry seems to be hesitant about electric boats. Compared to the rest of Europe, it is lagging behind in the electrification of its product range.

Electric boats are catching up, especially in the lower to high price segment. 38 per cent of the total electric boat supply on the online exchanges is in the entry-level and mid-price segment up to 50.000 EUR/GBP. So far, they are less common in the luxury segment, probably due to the overall increase in price sensitivity.

Balanced offer of new and used

The supply of new electric boats on the European online exchanges is slightly larger (57 per cent) than the supply of used ones (43 per cent), but overall, it is balanced. It remains to be seen how the second-hand market for e-boats will develop.

It is also interesting to note that electric boats sell forty per cent faster than diesel boats on the platforms.

Also read: EVOY plans world speed record attempt with electric boat

The top 5 brands on the marketplaces

The number of electric boats brands is growing. To find out which brands are particularly popular, boats.com evaluated the search behaviour of buyers on the marketplaces with the conclusion that prospective buyers look at boats from Silent particularly often. Electric boats of this brand receive the most views on the online exchanges.

On the rise

‘The Electric Boat Market Study 2023 paints an inhomogeneous picture in Europe in terms of both demand and supply,’ says Nadja Sörgel, Managing Director Europe at Boats Group. ‘In some markets we see a much higher interest and demand than in other European countries. Overall, we see a north-south divide on the supply side. We investigated that there is a large supply of electric boats in the lower and medium price segments on our platforms. This is important, because CO2-neutral mobility on the water should be available for every boat driver.’

In conclusion the study reveals that the electric boat market is on the rise and shows no signs of slowing down. Now, Northern European countries are at the forefront of this trend, with the largest supply and interest from buyers. In response to increased interest, electric boat brands are expanding their supply.

As the world becomes more environmentally conscious and people are looking for more renewable and sustainable options in terms of transportation, the global electric boat market will take off and gain significant market share in the next five years.

Milan-based boat dealer Valerio Tesei, Managing Partner of V Marine, assesses the market in the same way as Soergel. ‘Our core business is 70- to 100-foot-long yachts, but currently we are seeing stronger growth in longer yachts,’ says Tesei. Moreover, speed is no longer the decisive criterion when buying a boat. Tesei stresses that customers increasingly value comfort and durability.

Looking ahead, Tesei expects an increasing emphasis on eco-friendly practices in the boat industry. Both builders and buyers are embracing environmentally conscious pleasure boating: ‘Customers care more about comfort and a green attitude than how fast their boats go,’ notes Tesei.

The study

The study is based on data collected from 2019 to 2023 from the following online marketplaces: YachtWorld, boats.com, Boats and Outboards, Boatshop24, Annonces du Bateau, Botentekoop, Botenbank, Cosas de Barcos, iNautia, Lodzie24 and Boot24.com.

The following countries were considered in the analysis: UK, France, Netherlands, Italy, Spain, Greece, Croatia, Germany, Finland, Switzerland, Austria, Portugal, Belgium, Poland, Denmark, Norway and Sweden.

The study is published online here.

Yacht special in SWZ|Maritime

An important theme in SWZ|Maritime’s September 2023 yacht special is how yachts can be made more sustainable. The Dutch yacht builders are also aware of the drive towards more sustainable yachts. Topics in this special (appearing later this week) include how a yacht builder like Feadship seeks to make yachts more sustainable and how hydro generation can be used to generate electricity on board sailing yachts. In addition, we look at the plans of KM Yachtbuilders, Zwijnenburg, Larendael and Rubber Design.

Reference

- Electric boat and ship market size & share analysis – Growth trends & forecasts (2023-2028), Mordor Intelligence

Picture (top): Image by wirestock on Freepik.